The Dramatic Increase of Late Payments on a Global Scale

The Global Increase Of Late Invoice Payment, And Its Chain Reaction In Businesses

- The Global Increase Of Late Invoice Payment, And Its Chain Reaction In Businesses

- How Late Payment Has Risen Globally Due To COVID-19

- How The World’s Economy Is Influencing Late Payments Globally

- Country-by-country Comparisons Of Unpaid Invoices

- Business Sectors That Delay Invoice Payments The Most

- Reasons why larger companies make late payments of invoice:

- Forecast Of Unpaid Invoices

The figures for late invoices paid globally are rising with speed. Between 2015 and 2020, more than 228 million businesses across the UK, US, Australia, India, South Africa, etc, were paid within the range of 62-90 days outside the agreed date on their invoices.

This practice is affecting so many businesses as they are closing up due to bad cash flow, and if this habit continues, more businesses might fold, and countries’ economies will badly be affected.

How Late Payment Has Risen Globally Due To COVID-19

According to Dun and Bradstreet, the US payment situation in 2019 recorded an impressive 60% on-time payment against 38% of the total number that agreed to have delayed payments up to 30 days late, and 2% of the number who fell in the bracket of severely delinquent payments.

As stated by the same report, companies with fewer than 5 employees were the best payers, with 60% making their payment right in time.

This might look like the most impressive figure so far compared to other years, but placed against a pandemic year like 2020, the figures are about to take a plunge for the worst.

In 2020, global business revenue declined due to months of closed doors attributed to the pandemic, and the domino effect has been visible in other sectors of businesses – B2B, B2C, the small and large scale of commerce, etc.

In the UK for instance, Yahoo finance reported that weekly earnings slid down to £503 ($636) in April 2020 compared to the previous month, and this is a result of the unavoidable pandemic that forced businesses to clamp down on staff strength and slash salaries.

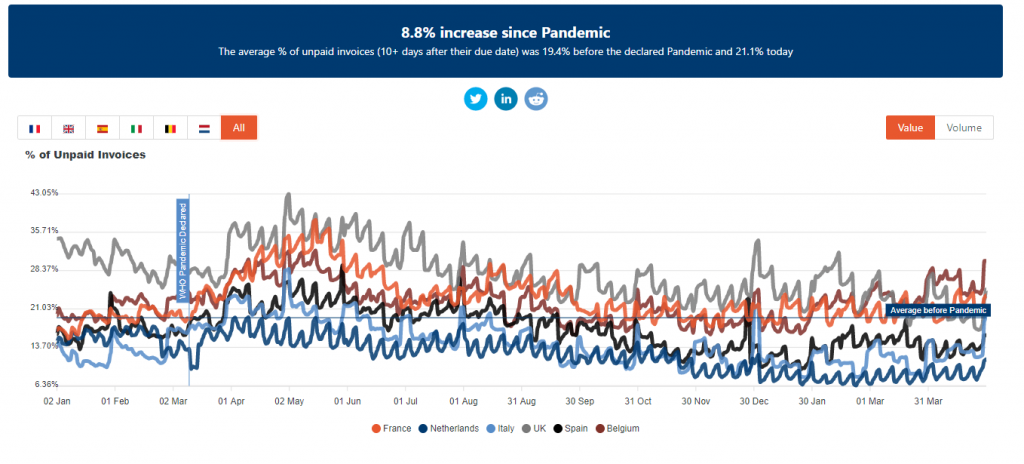

Studies from Sidetrade, a Paris-based software company that helps businesses with customer engagement, cash management, and invoice collection, stated that since the pandemic was announced earlier in March 2020, some countries have recorded an increased percentage of unpaid invoices which are at least overdue by 10 days. (Net 30,60,90 on invoice + 10 days)

Countries like Italy recorded the highest with 82% of unpaid invoices.

56% of delayed invoice payment was recorded in France, 25% in the Netherlands, 44% in Belgium, and 52% in Spain, all statistics are tied to the late invoice of 10 days or more.

According to Mark Sheldon, Sidetrade’s chief technology officer, “the sudden leap in unpaid invoices is “unprecedented” and can’t be easily compared to other previous recessions”

Comparing the pandemic recession in 2020 to the 2009 recession, Italy has notably defaulted in early payment, as data available to the European Commission, in 2011 stated that the Italian public authorities had an average payment period of 180 days, and an average delay of 90 days.

Due to this, the EU in February 2011, adopted Directive 2011/7/EU on curbing and handling late payment in commercial trading, and over time, more policies are being put out to make 30 Days or less a standard period any invoice should remain unpaid.

As other countries experienced a rise in delayed invoice payments, the world’s single largest economy the US, also experienced a surge in overdue invoice payments with the US production companies sitting on an unpaid invoice of over $200m.

Though Association of Independent Commercial Producers claimed that the amount owed to production companies are downplayed, as their poll which was conducted with more than 400 people present in a town hall meeting reported more than $1 million owed by 28% of companies, $500,000-$1 million owed by 23% while 34% owed between $100,000-$500,000.

Imagine what this figure would be by the end of 2020 if businesses still find it hard to trade fully due to the ongoing pandemic.

More records of overdue payment which was caused by the pandemic have also continued to rise over time.

Between 2019 and 2020, Atradius Payment Practices Barometer survey reported that there has been a 6% increase in late invoice payment by the US B2B trade, rising from 10% to 16%. This is strongly linked to some of the events that happened in the US that had a significant effect on their economy. Events like Trump’s trade war and the COVID-19 pandemic.

How The World’s Economy Is Influencing Late Payments Globally

Looking at the global financial crisis, which occurred between the year 2007 to the year 2008, the economy depleted and forced an increase of late payments in so many industries.

In real estate for instance, as reported by CNN, the recession caused a rise in late invoice payments of mortgages as about 0.78% of mortgage owners were forced to enter into foreclosure processes in 2007.

Compared to the preceding quarter of the year, foreclosure processes increased by 0.13, (from 0.65% of the second quarter to 0.78%), all due to late payments recorded after invoice issuance.

From this report, this was how lateness in payments was distributed across a net 30 and net 90 days – 5.9 percent of these homeowners took at least 30 days to clear their payment after invoices have been sent, while 1.26% took at least 90 days to service their debt.

While this figure has risen over time, Doug Duncan, chief economist of the lenders’ trade group said he is expecting the figures to continue to rise through 2008.

2 years later, in 2010, even when the recession was marked to have ended, reports from other industries like the automobile industry continued to report a steady increase in late payments from auto loan borrowers.

A report from APnews agreed that the Federal Reserve Bank of New York recorded that 5.3% of auto loan borrowers delayed payment by 90 Days or more in late 2010.

This number has continued to rise in the last 10 years because as of 2020, 7% of auto loan payment has been delayed after due to events like the COVID-19 recession. (Source: TransUnion)

Country-by-country Comparisons Of Unpaid Invoices

More than other countries, the UK and Italy are the two European countries that have recorded more unpaid invoices issued against other European countries.

In 2020, Italy’s B2B commercial trade recorded 82% of unpaid invoices due to the pandemic. According to SideTrade’s report;

“analysis of 26 million B2B invoices worth a collective $58.5 billion in trade has revealed a spike in delayed supplier payments.”

Most businesses blamed the pandemic for their inability to make payment after the agreed net on their invoice, but recent trend showed that despite 2020 being the year of pandemic and affecting some European countries, Italy has had a rising case of delayed invoice payment.

Atradius reported that in 2018, Italy had about 43.9% rate of unpaid invoices with up to 30 days delay after invoice have been issued, meaning that even at this rate which was considered fair compared to other countries and the pandemic year, the country’s B2B sector had a deep culture of delaying payments, and it only took the pandemic year to reveal that it could be two times worse than other years.

On the other side, France also recorded a terrible surge in delayed payment on invoices issued in 2020, with up to 56% delay in on-time payment according to Sidetrade. Compared to preceding years, Atradius claimed that in 2019, 63.4% of payments made in the B2B sector were made right in time.

This further clarifies that France is also heading to a serious trend in delayed payments if the percentage of delayed payments could rise to 56% in 2020.

Most often, businesses sitting on the timebomb of delayed payment get easily exposed by global crises. This was exactly what happened with Italy, France, Netherland, etc.

Across the continent, South Africa is also witnessing a rise in delayed invoice payment as Xero’s report stated that in 2019, 91% out of 500 surveyed SMEs were being affected by late payments and it took an average of 18 days before their suppliers paid up their debts.

Due to the rise of late payments in South Africa, so many reports looked at the history and consequences of South Africa’s unpaid invoice.

t was found that the South African government are the lead offenders in delayed payment, and the total number of SME liquidations caused by late payment increased by 15.4% in September 2016 compared to the year 2015 which was quite minimal.

In a state where 1 out of every 5 businesses is struggling to survive the late payment consequence, policymakers would swing into full action to salvage the situation to avoid an economic crash as South Africa’s economy is hanging on the output of SMEs.

Looking at the UK’s trend and their position in a late payment from 2015 to 2020, you will find out that there was a significant rise up to 12% from 3rd quarter of 2015 vs 4th quarter of the same year, with up to 27 days of delayed payment according to Euler Hermes, with construction companies leading as the most offenders in all UK sectors (31% of the 17 surveyed sectors)

In the year 2016, delay in unpaid invoices continued to grow as the construction sector alone added 6% (37%) by the 2nd quarter of 2016, making a total of 60% delayed payment on invoices in 2016 with an average value of delayed payment reaching £51,826.

For the number of days delayed before payment, UK SMEs took up to 5.9 days more to clear payment outside the days on the invoice.

This report from Peer To Peer Finance News also stated that the values also increased in the year 2017 as the average days it took UK SMEs to make payments went from 5.9 days in 2016 to 18.4 days in 2017, and the percentage of late invoice payment also went from 60% to 62.3%.

Does Brexit have a hand in the steady increase of late invoice payment in the UK? Absolutely yes.

Since 23rd June 2016 after 51.9% of the total vote agreed that the UK should leave the EU, businesses have taken more days to clear unpaid invoices.

In 2017, it took an average of 18.4 days for unpaid invoices to get cleared, that is rising from 5.9 days from the previous year. Two years later, that number continued to rise to 23 days as the idea of Brexit continued to affect cash flow directly and indirectly.

Business Sectors That Delay Invoice Payments The Most

Unpaid invoices might be rising dramatically on a global scale, but not all sectors are equally owed, as some sectors are struggling to get up to 45% of their invoices paid.

The UK Domain’s report stated that construction companies make up the 14% of the unpaid invoices in the UK between 2017 and 2020. This is purely true due to the capital involved in their projects, and also the length of time it takes for the right authority in these firms to make payment.

Multiple reports in 2020 also have shown that construction companies would always remain one of the sectors to get a paycheque pretty late due to the nature of their business.

Invoiceinsure pegged their result at 31% of unpaid invoices in the UK.

TSheets and Levelset also surveyed to find out how bad unpaid invoices have risen in the construction sector, and also its effect on their businesses, out of 195 surveyed managers and construction company owners, 37% of the respondents complained of receiving payment 30 days after the project completion or more.

In the US, reports claimed that professional and legal service businesses were the most affected by late invoice payment, with up to 70% of the respondents agreeing to have received payment for their services.

Manufacturing companies also witnessed a delay in payment, with up to 57% of their payments delayed by 30 days or more outside the due date. (Source: Accountability Daily)

Red Flagalso has a similar report regarding the sectors that were badly hit by late payment of the invoice in 2019, with the professional service sector and construction companies summing up to £2.14390881.

Top 10 sectors that suffered unpaid debt in 2019 (Red Flag Alert data):

| Sector | Sum of Total Insolvent Amount |

| Professional Services | £1,390,142,335.85 |

| Construction | £753,766,475.68 |

| Support Services | £636,588,814.23 |

| General Retailers | £505,205,123.31 |

| Real Estate & Property Services | £184,102,808.24 |

| Wholesale | £119,971,301.12 |

| Travel & Tourism | £95,081,449.70 |

| Other Manufacturing | £86,014,156.98 |

| Automotive | £82,340,554.81 |

| Industrial Transportation & Logistics | £81,877,024.48 |

Reasons why larger companies make late payments of invoice:

Cash flow benefit – This is one of the most common reasons why companies hold back due payments. These due payments are being held back because businesses want to maximize cash at hand for other business purposes.

Here are two major ways businesses benefit from extra cash flow that comes from late payments –

1. To raise capital for other business transactions –

The motivation behind this is the extra bulk of cash that businesses can access for other business activities, maybe to acquire other supplies, offset other debts, or simply to reinvest into the business.

Take for instance, if an imaginary company called Raph Grace $ Co. pays their suppliers $100,000 every month for supplies on payment due dates without changing the credit period, this means that in month one, they have to pay out $100,000 from their cash flow to settle this debt.

This same practice will also occur in month 2 as long as they don’t take any credit period. This means that, in a space of 12 months, Raph Grace $ Co. must have paid $1,200,000 to their supplier as long as they stayed within their payment due date (the period when payments are made immediately after every purchase).

2. To maximize long-term investment profit –

Here, the motivation isn’t just the cash at hand for running business operations, but the long-term investment profit that comes from reinvesting the funds gotten from delayed payment.

Take for instance, if Raph Grace $ Co. reinvests the $100,000 gotten from delayed payment into other products, and for every $100,000 investment they make, they generate a profit of $1,000. In 12 months of continuous reinvestment, they will make an additional profit of $1,200.

For a mathematical representation of this result, here is a formula to calculate the savings from delaying payment.

Administrative issues –

Another cause of late payment is the processes that it takes larger companies to make a conclusion in making payment.

Larger companies have different departments and administrative personnel that must take part in every process of finance. The time it takes these companies to finalize their payments, their invoice might slip into late payment with a request for an extra credit period.

Compared to smaller companies, there is a straight-forward pattern for making payments in companies with fewer employees. The financial department has a direct connection to the business owner or the CEO, and mostly, it takes quite a compressed time to pay off due debts.

Forecast Of Unpaid Invoices

From the recent behavior of most countries and sectors, it’s easily predictable that late payment will continue to rise regardless of policies in place to curb this behavior.

Countries like the UK didn’t respond greatly to unpaid invoices and late payment immediately after the recession in 2009, instead, their figures continued to rise to an average payment period of 180 days, and an average delay of 90 days.

Year 2021 might be just another 2010 to the UK’s B2B commercial sector as recovering from the 2009 pandemic didn’t have much positive results in their unpaid invoice data.

Red Flag Alert is also predicting that in 2021, unpaid invoices will rise by £24bn in value and for the next 18 months, businesses affected by unpaid invoices in 2020 will be out of business.

As almost every sector in all businesses are experiencing a rise in delayed invoice payment, policymakers are taking all actions to slow the rise as predictions for years ahead are hinting at a continued rise.

Countries like the UK, Italy, US, etc, also have to be prepared ahead of time to at least make sure that unpaid invoices are reduced by 50% of what it is in 2020, and average days before payment are also reduced by half.